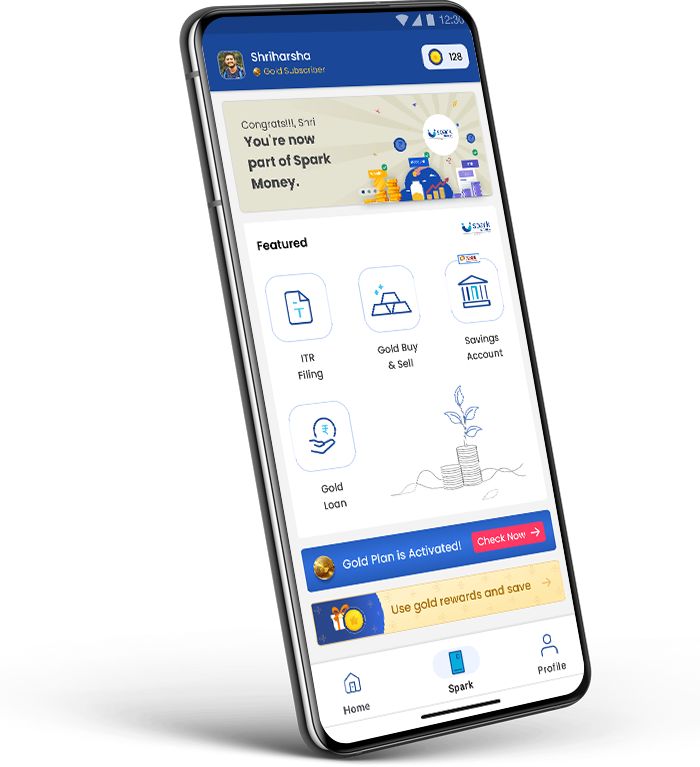

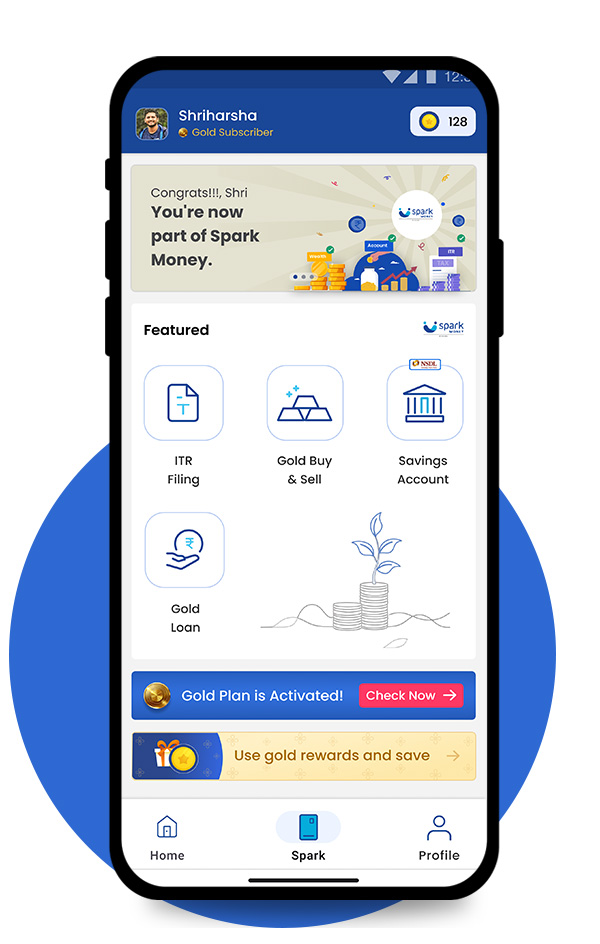

Spark Money – The All in one account

By Dvara Money

Spark Money brings a seamless, mobile-first financial experience to India’s informal workforce. Whether you’re a delivery partner, cab driver or small-business owner, our app puts savings, investments and credit at your fingertips. Invest in digital gold from just ₹100, open a zero-balance savings account, file your ITR with expert assistance and unlock affordable gold loans—all within minutes. With proactive AI insights and on-ground Spark Dost champions guiding you every step of the way, managing money has never been more accessible.

Adjust gold savings any time, claim tax refunds without the usual paperwork and secure quick collateralised loans at competitive rates. No hidden fees, no delays—just straightforward financial services designed around you.

-

Trusted financial partner

Experience new-age financial services that are tailored for you

-

Easy to use & fully transparent

Simple and easy to understand

-

Supercharge your financial journey

Take steps to realise your financial goals and track your expenses effectively

-

Private & Secure

Highest security and confidentiality of data

-

Multiple language customer support

Support in a language you know and understand

Spark Money brings you

- Digital Gold

- Savings Account

- ITR – Income Tax Returns Filing Service

- Gold Loan

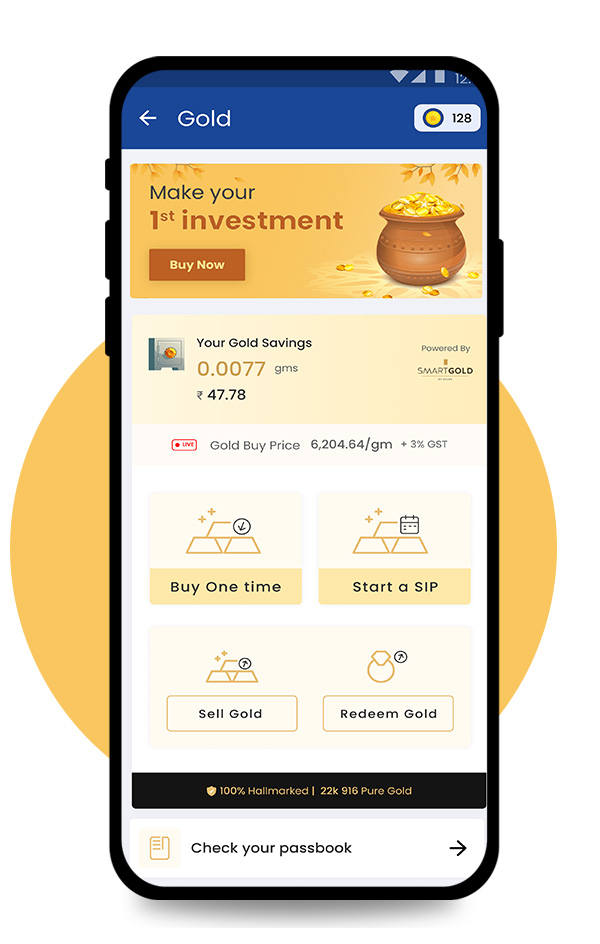

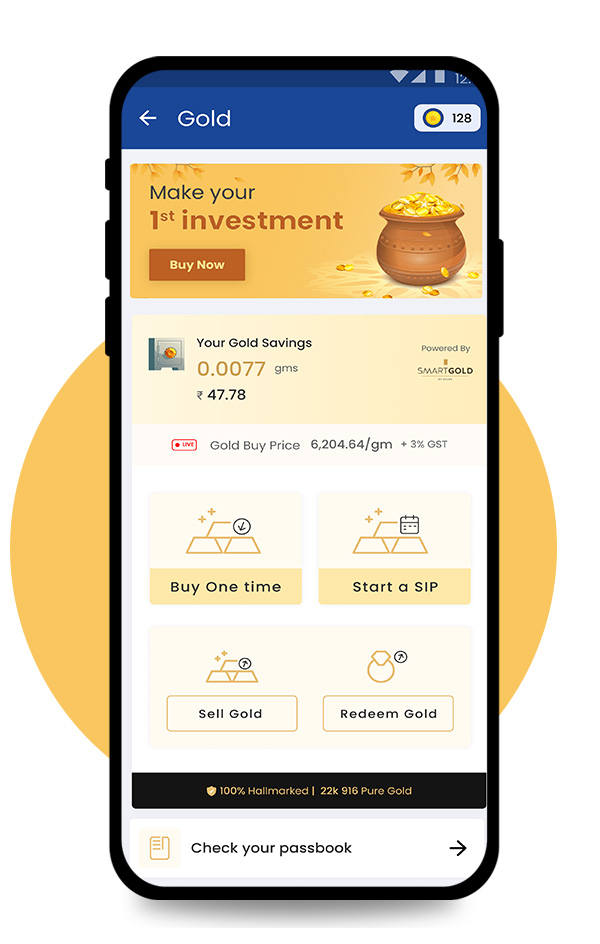

Digital Gold

Invest from just ₹100 in pure digital or physical gold at live market prices—with minimal making charges. Pause, top-up or redeem anytime for your child’s education, festivals or emergencies, all secured in vault storage.

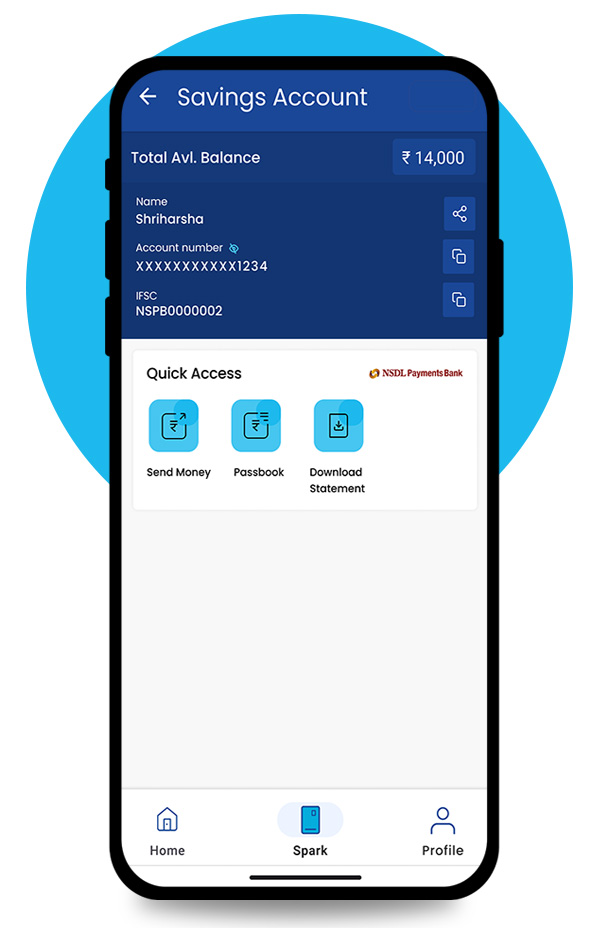

Savings Account

Open a zero-balance account in minutes, with optional debit card and free fund transfers. Earn gold rewards and receive tax refunds directly—seamlessly linked with all your Spark services.

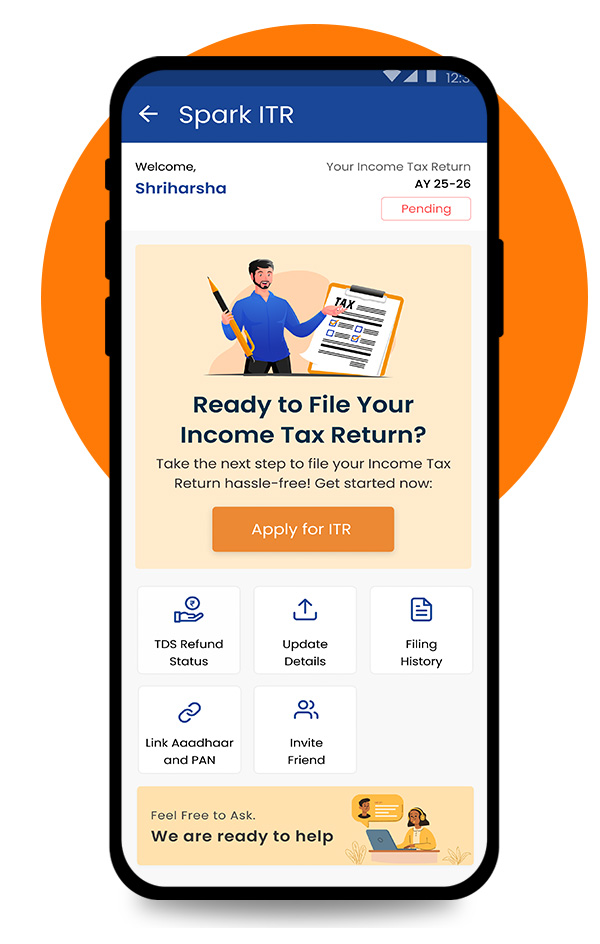

ITR – Income Tax Returns Filing Service

File your returns via the app or at a Spark Dost centre with expert-backed guidance. Enjoy error-free e-filing, direct refund deposit and digital income proof to strengthen your loan eligibility.

Gold Loan

Unlock instant credit against your gold holdings at competitive interest rates. Get disbursed in minutes with minimal paperwork, flexible tenors and easy balance transfers—so you can manage cash flows without stress.